This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Loading...

PC financing / hire purchase (only available in germany)

Order the PC of your choice today - and your order will go into production as soon as the financing bank1 has approved your application.

Individual installments and terms as well as the personal carefree package3 ensure flexibility and financial security – online shopping at CSL Computer can be so easy and convenient.

This payment method is only available to customers residing in Germany.

Do you still have questions about financing? No problem - our Financing-FAQ

includes frequently asked questions and the corresponding answers.

In addition, you receive a credit line depending on the creditworthiness with the Consors Finanz Mastercard®. With the Consors Finanz Mastercard® you have a fixed credit limit, you can shop worldwide at merchants who accept MasterCard® and you can withdraw cash. Further information on the Consors Finanz Mastercard® is available here.

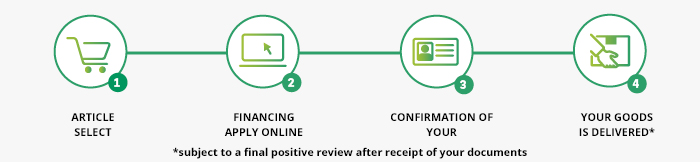

PC financing is that easy:

- Choose "Financing" as a payment method.

- After completing your order, fill out the financing application from our partner bank online.1

- You can then complete the financing application online using WebID Video Ident or WebID Account Ident. Alternatively, you can have your identity confirmed by Postident in the nearest Deutsche Post branch and send the documents by post.

- Your order will be processed as soon as the financing bank1 has processed your financing application.2

The bank needs these documents:

- Signed loan agreement (electronically or by post)

- Last proof of salary / for the self-employed the last BWA (with a financing amount of €4,000 or more; in individual cases also a financing amount of less than €4,000)

- A copy of the residence permit for non-EU nationals

- Students: Copy of a valid student ID or certificate of enrollment for the current semester and copy of the EC/Maestro or credit card

- Trainees: Copy of a current pay slip and copy of the ec/Maestro or credit card

The following requirements must be met for the PC installment purchase:

- You are at least 18 years old.

- The financing amount is between €100 and €10,000.

- You are an employee and have been working for your current employer for at least 3 months.

- Your employment is open-ended for the next 12 months / or you are a pensioner with an open-ended pension / or you have been self-employed for at least 24 months.

- You have a regular net income of at least €650.

- You do not have a negative Schufa entry.

How to get your order:

Like all banks, our partner bank1 is legally obliged to carry out a legitimation check. The identity of all new customers is checked before a loan is granted. This test is also for your own safety. You have the choice of obtaining the legitimation online by the video identification procedure, the account identification procedure (with a PC, tablet or smartphone) or in the nearest Deutsche Post branch by PostIdent > want to perform. The contract can also be signed either online with an electronic signature or you sign by hand and send the contract to our partner bank. An address sheet for free return of your documents is enclosed with the loan agreement. Please note that sending the contract by post will take a few additional days. Please note that provisionally issued German identity cards are not accepted as proof of identity.

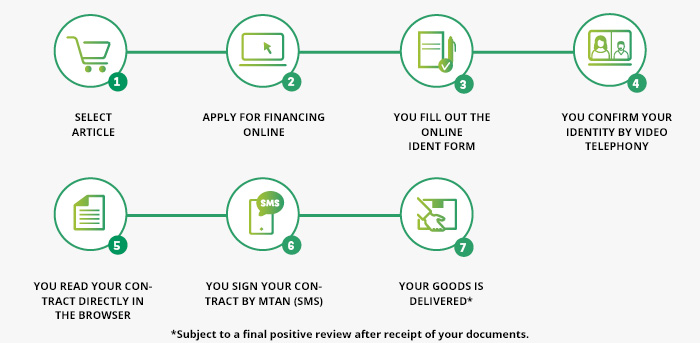

Fully digital financing agreement - How it works:

- Decide on the "Financing" payment method: After you have placed your goods in the shopping cart, you can decide on financing when you go to the checkout. You go through the short online application process of our partner bank1. After the provisional funding approval, choose the option "Complete online now" to complete the application digitally.

- Online identification: Your identification is carried out conveniently with a video call, the so-called Video Ident - simply and directly via your browser or app. Employees guide you through the process step by step. With the Ident account, take a picture of your identity document and your face. Then log in to your online banking.

- Digital signature: Following online identification, you will receive an mTAN via SMS, which you can enter in the field provided for confirmation. The contract is then legally signed and concluded online.

- Look forward to the speedy delivery: After completing the online transaction, your goods can be shipped immediately, in contrast to the PostIdent procedure!

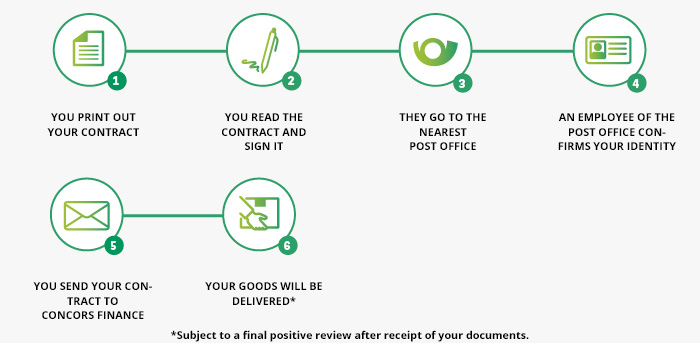

Legitimation with PostIdent – How it works:

- Decide on the "Financing" payment method: After you have placed your goods in the shopping cart, you can decide on financing when you go to the checkout. You go through the short online application process of our partner bank1. After the preliminary credit approval, choose to print the contract and mail it.

- Identify yourself at a post office: Print out your application and read through your documents at your leisure. Sign the contract in the spaces provided and enclose the documents required by the bank. Seal the documents in an envelope and take it with the Postident form to the nearest post office. A Swiss Post employee will confirm your identity using your valid ID card or passport. Please note that you send your signed loan agreement by post to our partner bank1. An address sheet for free return of your documents is enclosed with the loan agreement.

- Look forward to the delivery: After receipt of the financing application by our partner bank1, we will deliver the goods you have ordered to you immediately (subject to a final positive check after receipt of your documents).

How to complete your loan agreement online:

In addition to the option of printing out your loan agreement and sending it in by post, our partner bank1 offers the option of concluding your loan agreement with the electronic signature of WebID Solutions GmbH. You can use this to sign your loan agreement fully electronically and in just a few minutes, without having to go to the post office or print it out.

You will need:

- A smartphone, tablet or other device with a webcam

- A valid identification document (ID card or passport)

Procedure:

- Click on the "Buy online now" link. You will then be taken to the form page of our partner WebID.

- Fill out the form with your data and connect easily and securely with a WebID employee via video call.

- The WebID employee will confirm your identity in the video call using your valid ID document.

- To complete the legitimation, you will receive a TAN (transaction number) via SMS. Please enter this in the field provided.

- After successful identification, you will be given the opportunity to sign your loan agreement.

- Read the credit agreement on the WebID website and confirm that you wish to sign it using a qualified electronic signature.

- Confirm the signature using a password and another TAN (transaction number) via SMS.

- Your loan agreement will now be digitally signed by the trust service provider A-Trust and sent directly to our partner bank1.

- Your loan agreement has now been legally signed.

Do you have any questions about the PC installment purchase?

Call our experts Monday to Friday from 8am to 7pm, Saturday from 9am to 3pm at +49 511 / 76 900 100. You can also email us using our contact form. Please select »Financing« as subject.

1 Mediation takes place exclusively for the lender BNP Paribas S.A. Branch Germany, Munich location: Ruedesheimer Strasse 31, 80686 Munich.

2 Subject to a final positive check after receipt of your documents.

3 The carefree package offers insurance protection against various risks through inclusion in a group insurance policy. The insurer pays the installments in the event of unemployment through no fault of your own, incapacity to work or in the event of death. Please refer to the General Insurance Conditions for details.

Ask our experts for advice

+49 511 / 76 900 100

(Mon.-Fri. 8 am – 7 pm / Sat. 9 am – 3 pm)

FREQUENTLY ASKED QUESTIONS

REVIEWS

Card / Bar

Card / Bar